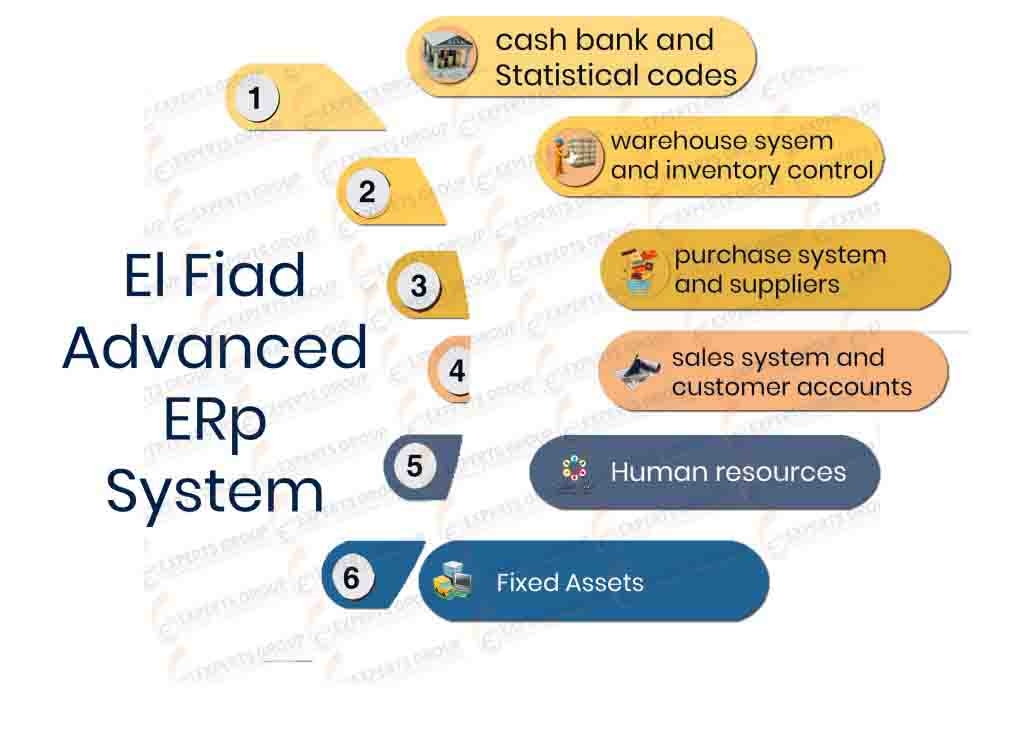

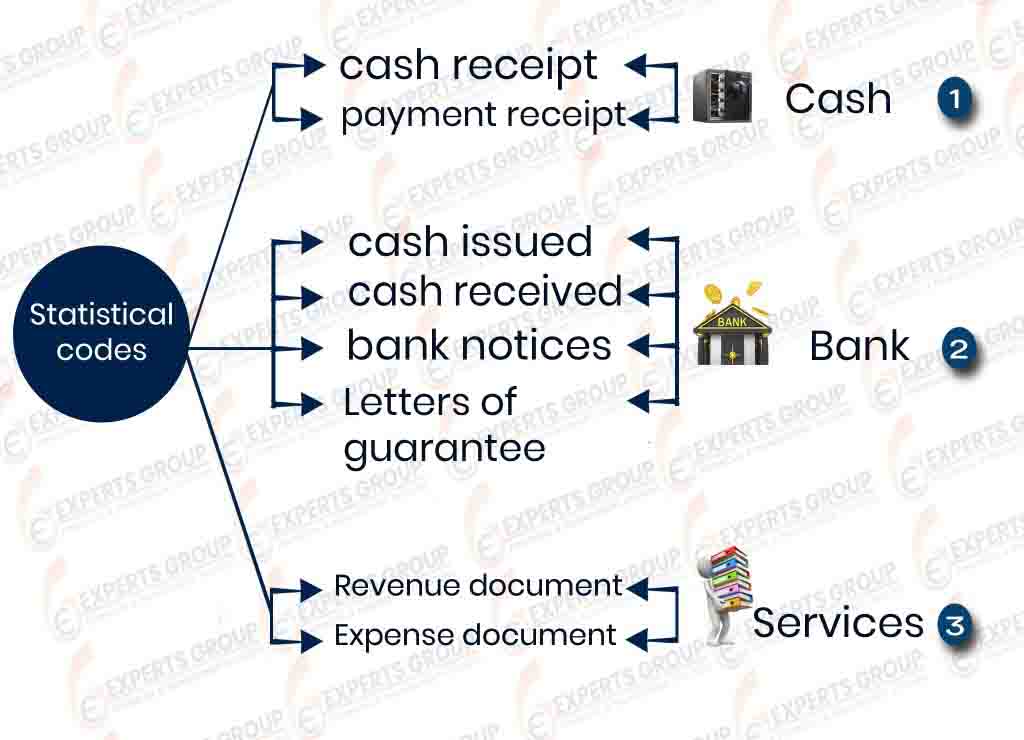

Financial Module

Cash receipt ( Incoming )

By cash receipts , we can record incoming cash from outside the company such as customers payments or internal bodies such as proceeds of salesmen , Covenant settlements or transfers from banks … etc.

Cash receipt (Issued)

Payment of any obligations on a company such as suppliers, payment of expenses, salaries, bank transfer…etc.

Check ( issued )

The payment of any obligation on the company to any entity through the bank indicating the date of issue of the check, the date of maturity of the check and the bank issued by it and the person or company to be repaid

Check ( Incoming)

recording any debts from any person such as customers through bank checks explaining the date of collection of the check and client’s bank

Bank Notice

Proof of any deposits in the company’s bank accounts , such as deposit of customers or transfers from abroad, transfers from the treasury to the bank, financing of the bank account through the partners’ neighbors, bank returns, …etc.

Bank Debit Notice

Proof of any withdrawals made on the company’s bank account or transfers to pay a liability to the company, such as repayments of overseas suppliers in case of import, as well as the opening of the documentary credit or debits by the bank such as payment of bank expenses or interest, etc

Letter of guarantee

There are two types of letters of guarantee, letters of guarantee issued, and letters of guarantee contained, used in the case of tender entry or otherwise

Revenue Invoice

In the case of companies that provide certain services to their customers, such as transport companies or customs clearance companies, indicating the services, price of each service, and the various types of tax, such as sales tax, discount tax, addition…etc.

Expense Invoice

When requesting a specific service from some companies that provide services, such as transporting goods to the port, customs clearance service or tax services, a service invoice is recorded showing the price of each service separately and sales taxes

Statistical items

Where some accounts can be analyzed without analysis in the accounts tree, which leads to the large number of accounts and levels in the accounts tree , where it requires a great effort in the search and recording financial transactions, through using statistical items you can analyze some accounts or expenses like selling expenses ,car expenses you can record the costs of each Car like fuel – maintenance – spare parts ,fixes… etc.

Financial reports

Through this module we can extract many periodic reports (daily, monthly and annual) , financial statements such as profit and loss, balance sheet, income statement, cash budget, cash flow statement

Designing reports

sometimes top management needs reports with a specific shape, by Report Designer,

you can create any financial report with any columns and aggregations.

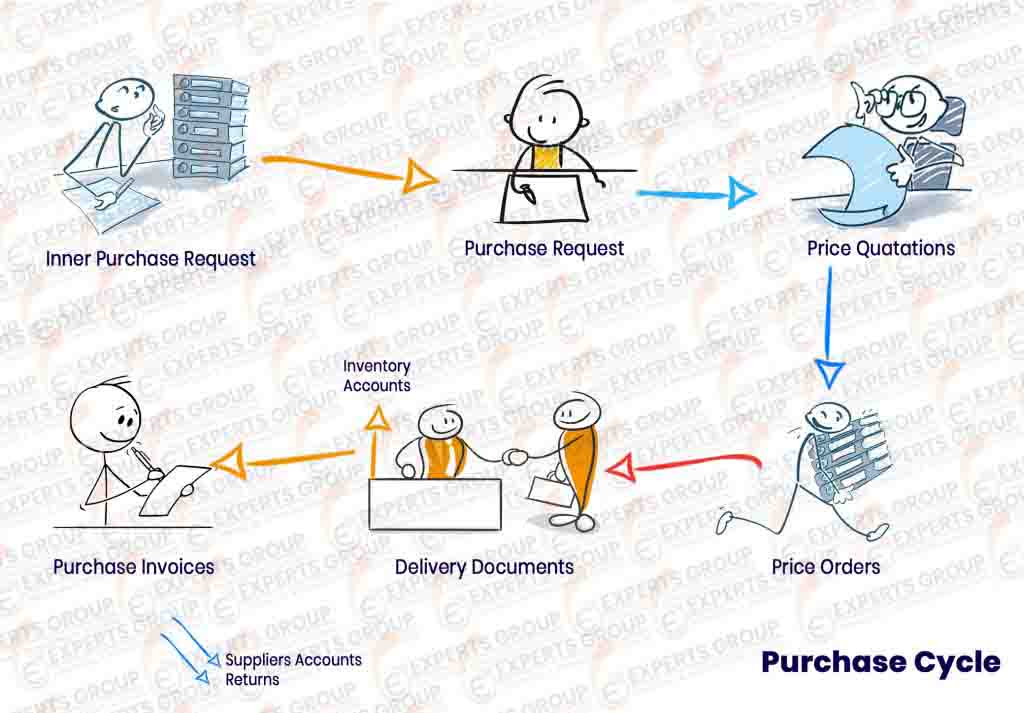

Purchasing Module

Purchasing cycle

- Purchase request ( PR )

The requests submitted by the warehouses to the purchasing department through which the needs of each warehouse are determined to fill the shortage with the identification of the required items showing the quantities of each item, the procurement department sorts the orders and is submitted to the senior management for approval and take the necessary measures to implement them

- Gathering purchase requests

purchasing department collect all requests from all warehouses in one request

containing all items, and dividing this request to many POs .

- Quotations

Record all the quotations provided by the suppliers, specifying the supplier and the items that can be supplied to the company, Delivery period, any taxes and expenses.

- Purchase Order (PO)

The Purchasing Department will issue a purchase order for each supplier based on the selection of the best price and the best quality, with a time limit for the supply, to meet the needs of the Department of warehouses submitted purchase orders approved by the senior management

- Purchase Invoice

The supplier sends the purchase invoice to the company at the prices agreed upon by the purchase order, stating how the payment is made, cash or forward, all deductions and taxes, such as sales tax or discount tax , After the invoice is registered, an accounting entry is generated automatically and the various account balances are changed.

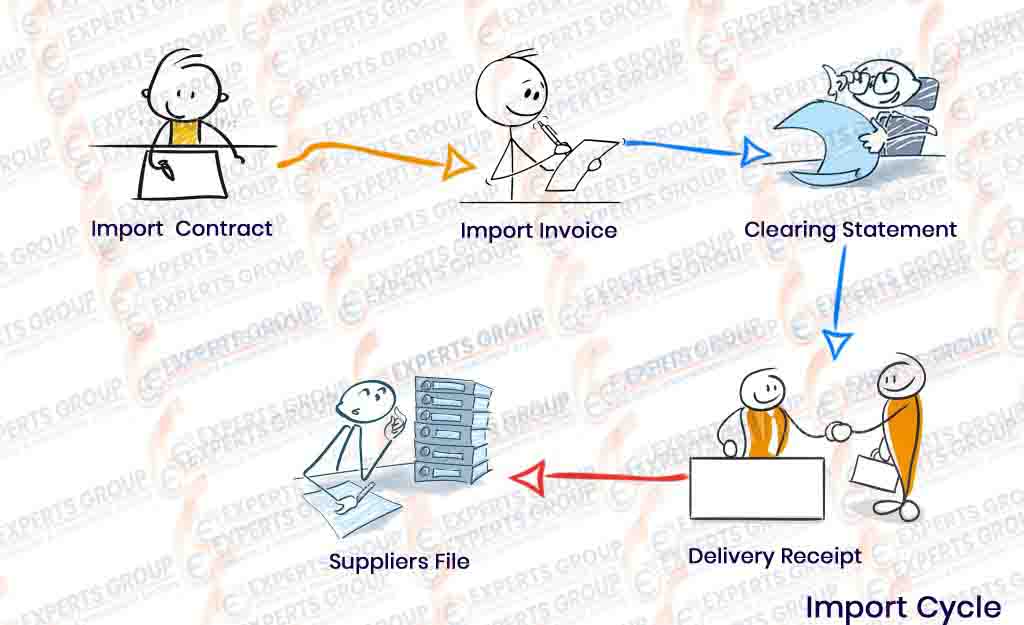

Importing cycle

- Import Contract

Sometimes when the company imports items from the external supplier, the purchasing department in agreement with the external supplier to supply the items at a specified purchase price and supply within a certain period of time, with an agreement on the terms of payment, and this is done through an import contract to ensure the seriousness of the deal, and the company is not exposed to risks Lack of raw materials for manufacturing during the year - Import Invoice

The supplier sends the import invoice to the company in accordance with the contract concluded with the company, showing the quantity and value of the goods received, after opening a documentary credit through the bank, and the invoice shows the shipping expenses in foreign currency and any other expenses, and shipping expenses can be distributed on items in several ways such as cost or weight or size - Clearing Statement

Company is in agreement with the clearance offices to receive the goods from the customs, and the customs broker will pay the various expenses such as tax, flooring….etc.

The Savior provides a statement to the company by the expenses that were spent on the goods until the arrival of the stores - Delivery Receipt

The warehouse department receives the goods received with a receipt. The goods are priced automatically through the system after all expenses are distributed at their exchange rate

- Suppliers File

- A complete file for each supplier indicating the company, name, address, phone and

website, as well as the follow-up official with this supplier. - Divide suppliers into local and external suppliers

- Each supplier has one or many price lists

- Expenses with invoice such as transportation, tips and so on

- All suppliers are dealt with by any means, cash or forward

- Different payment methods, by cash, checks and bank transfers.

Sales Module

Sales cycle

- Quotations

When customers request clarification of the prices of some items sold by the company, the company makes quotations to customers showing the prices of items and the period of supply and terms of payment and any deductions or taxes paid by the customer

- Sales Order ( SO )

After approval of the prices submitted by sending a sale order to the company in the required goods according to the prices agreed through the offers submitted or through the sales price lists of the company - Sales Invoice

The sales department issues a sales invoice at the prices agreed upon in the sale order, stating all deductions and taxes, whether sales tax or deduction tax. The system generates an accounting entry and directly influences customer and other accounts - Delivery Receipt

The warehouse department will deliver the goods based on the sales order through the delivery of goods only - Reservation goods

The company makes a reservation of goods in the items in the sale order and does not exist in the stores, or the goods that are in the stores and the customer does not want to receive them at the moment, and thus ensures not to dispose of them

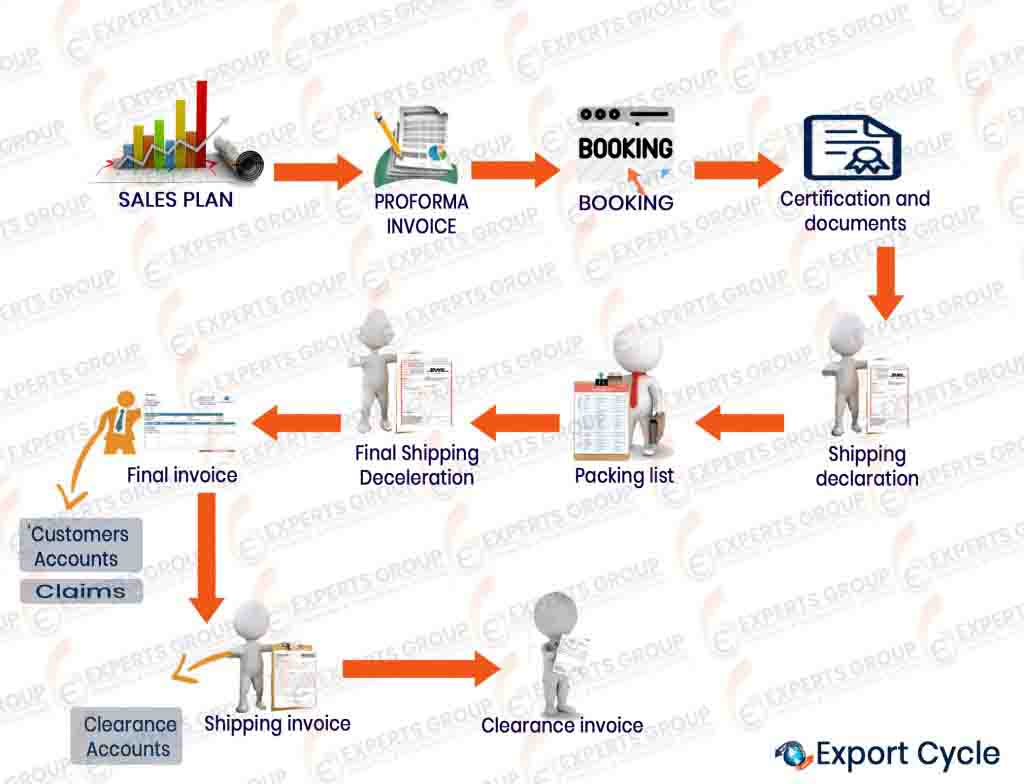

Export Cycle

After preparing the final product the export department starts to execute all procedures to export the final product starting with :-

Human Resources (HR)

- Organizational Chart

It represents the schematic form of the various departments of the company (main – sub – sections) within the company, which is a tree structure that starts from the top management and ends with the lower departments and sections - Job Card

It represents the schematic form (financial manager – accounts manager – accountant …… etc.) with the job grades for each card and the experience of each employee, and the degree of qualification required by the job with a statement of the objective. - Employees File

– Specific recruitment data for each employee (date of appointment – department or department –

social insurance – branch – rosary – wage system …… etc.).

– Labor’s personal data (gender, marital status, card number, educational qualification, etc.).

– Vocabulary of salary (salary basis – allowances) obtained by the labor or employee.

- Administrative regulations

Which can be configured to suit the system and working conditions of any company and include: –

• List of delays.

• List of overtime.

• List of official holidays.

• List of commissions.

• Sanctions Regulation.

It can calculate the extra hours, commissions and the value of working hours during official holidays.

–Also calculate the value of deductions represented in the value of the delay by linking with the record of attendance and leave, and other deductions such as social insurance and advances and the value of any other sanctions

- Functional Groups

You can classify employees into groups ,each group has some common characteristics such as Wages system, daily working hours and regulations, morning and evening shifts.

- Salary Systems

There are several salary systems such as :-

- Monthly system

- Duration of remuneration system (daily, weekly, unequal periods)